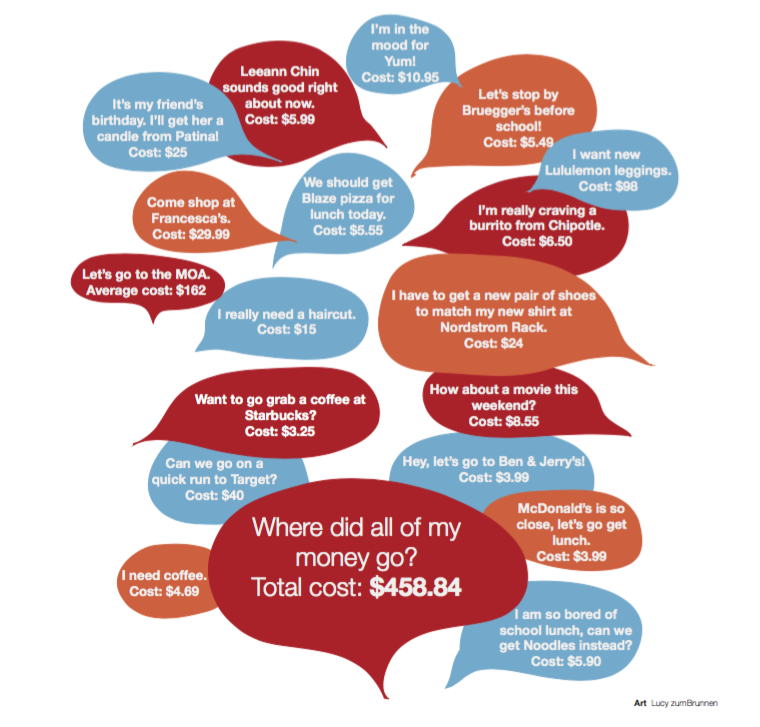

It all adds up

The importance of saving for life beyond high school

December 21, 2018

As he begins to apply for jobs and earn income, sophomore Andrew Grossman said he is conscientious about having a SMART budget.

“I think a budget would be maybe every single week put some sort of the percentage of money I get into what I like or what I need, like if something breaks, I could work towards that and try and get that before everything else,” Grossman said.

According to personal finance teacher Abigail Lugo, a good budget is one that is specific, measurable, attainable, realistic and time-bound (SMART).

“A budget is (when) you’re planning ahead and you’re looking at your income and subtracting out your expenses. Budgets can be SMART too, you are going to do your best guess on what you are going to spend in the category of expenses,” Lugo said. “I would think it is a SMART budget if the biggest part (is it) being attainable. If it is not attainable to save 50 percent of your income, then don’t put that in there if that’s your goal because you still might have other expenses to pay.”

Grossman said some students underestimate the importance of saving money for unexpected expenses.

“(Some students) don’t realize that they need money for other things, and they just work toward one thing when they should be working for more than one,” Grossman said.

Lugo said she believes the most important lesson in financial literacy is the ability to allocate finances toward savings.

“Number one is always pay yourself first. You work really hard for your money that you make, so pay yourself — put money in savings,” Lugo said.

Because they don’t account for emergency expenses, many Americans are unprepared for retirement. According to the Federal Reserve’s Survey of Consumer Finances, the average combined Individual Retirement Account (IRA) and defined contribution pension account balance was $237,600 in 2016.

Lugo said she recommends students begin saving for retirement as soon as possible.

“I would say when you turn 18 or start your first job, most companies offer contribution to your retirement account, so I would put money in there as soon as you can,” Lugo said. “When you are younger you should be putting 10 percent in there if you can, but a lot of companies will match what you put in there up to a certain amount.”

According to Lugo, students should also take advantage of Roth IRAs, which are after-tax retirement savings accounts. According to Business Insider, savers can contribute a maximum of $5,500 to their combined IRA and Roth IRA accounts per year.

“An IRA is an individual retirement account, so you are saving money for retirement. A Roth (IRA) is after-tax dollars and then when you put in your dollars that you have already paid taxes on. The idea is that when you retire and you pull money out of that account, you do not pay taxes again,” Lugo said. “That is why it is better for when you are younger to do your Roth IRA and that goes into why that was created too, as an incentive to start young versus pulling out taxes when you are in a higher tax bracket.”

Lugo said starting to save young is the best way to use a Roth IRA.

“It is like a snowball,” Lugo said. “The sooner you can start putting money in, the faster it will start growing because your interest makes interest on top of interest. You can actually do more if you started saving at 18 until you were 35, if you just stopped, you would have more money in there than if you started at the age of 35 and still saved until you were the age of 65.”