Spreading knowledge on college

Wealth advisor teaches students about college financing

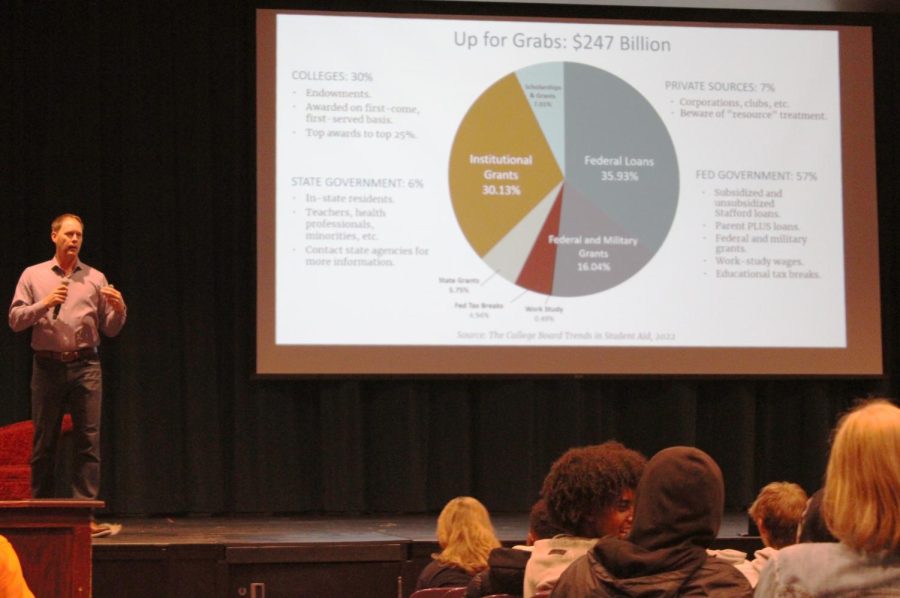

Ben Johnson speaks to sophomores and juniors April 19 in the auditorium. Johnson talked about the various ways high school students can avoid college debt.

April 20, 2023

One of the first guest speakers at Park since COVID-19, gathered sophomores and juniors in the auditorium and connected with seniors on Zoom to inform them about financial planning for college April 19.

Guest speaker Ben Johnson is a wealth advisor and financial planner who specializes in college strategies. According to Johnson, he aims to increase awareness on financial opportunities for students.

“My goals are to provide awareness and education to students on some of the realities about how expensive college is and figure out ways to advance their education at a more affordable price instead of doing what everybody else is doing,” Johnson said. “It’s common to watch what our peers do and follow that, but there is a student debt problem going on in the world.”

Sophomore Sela Myers said she appreciates guest speakers when they cover engaging topics.

“I like when guest speakers come,” Myers said. “Obviously, it needs to be something that is important and people are interested in because I don’t think they’re productive.”

Johnson spent time outlining different strategies to reduce the cost of college and increase students’ chances at admission. Junior Hank Heiland said he found the meeting helpful because of the various strategies he learned.

“(The meeting) was extremely beneficial because I learned much better financial options such as meeting with college admissions counselors and learning ways to cut down on prices,” Heiland said.

According to Johnson, the salary a career offers and the degree a student earns in college often makes them feel restricted after college.

“You might feel trapped in the job that you want to pursue because you have a degree for a certain thing, but you need to make a certain amount of money,” Johnson said. “It’s helping students launch successfully instead of going to school, racking up a ton of debt and then coming back home to work at a coffee shop and struggle to find a job.”

Myers said the meeting taught her that forming relationships through the college application process is beneficial to having a balanced financial post-college life.

“Try to gain as many opportunities as you can to have the best financial situation for college and/or any after high school commitments,” Myers said. “Also making relationships with people and making connections so that you can have the best financial situation after high school.”

According to Johnson, college is what students make of it regardless of the university title.

“It’s fun, it’s expensive and you can make the best of just about any experience regardless of where you go,” Johnson said. “I’ve seen more students get more bang for their college buck by participating in alumni networks and making connections at their college regardless of the name brand of the school they go to.”