Tax levy aims to improve local schools

Proposed increase would expand academic budget

October 23, 2013

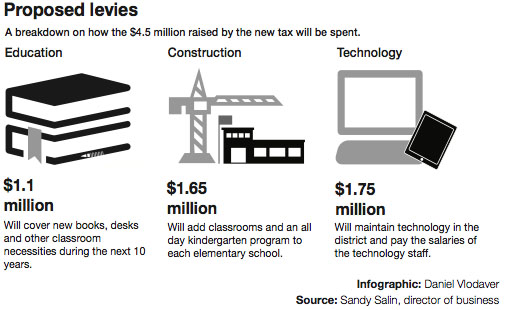

When St. Louis Park voters go to the polls Nov. 5 they will be voting for more than just School Board members. A proposed tax increase of 4 percent to go toward St. Louis Park schools will also be on the ballot.

The money raised by the tax will be put toward school buildings, staffing and technology. The tax consists of three proposals: a technology levy, a bond referendum levy and an operating levy.

A levy is a capital tax put on property by the government. The levy is based on the property value of taxpayers in the city.

According to School Board member Bruce Richardson, if the new tax is not approved by voters, they would have to petition the state for the extra funding needed.

“However this would be a lengthy process and we don’t expect any of our plans to fail,” Richardson said.

According to Superintendent Rob Metz, the levy proposals are possible because of new legislature.

“The legislature changed some laws this year and this enabled us to ask for this (tax),” Metz said. “The levy will enable us to keep our programming and keep class sizes as low as possible.”

Although the tax is designed to help students succeed in school, it is not unanimously embraced by all students.

Sophomore Marco Salazar said he thinks the tax should not be imposed on all citizens, since not all of them have chil- dren enrolled in the school system.

“I don’t think it’s fair that families without kids have to pay for better schools,” Salazar said.

However, junior Hannah Holmquist said she would be in favor of the tax if she were a taxpayer.

“As long as I knew where the money was going, I wouldn’t mind,” she said.